At a work session August 14, 2023, the Richardson City Council reviewed the 2023-2024 budget proposed by City Manager Don Magner. With property appraisals up, the City is awash in additional tax revenue. With the economy booming (historically low unemployment and solid consumer spending), public complaints about the cost of local government are unusually muted. There were no public speakers at this week's Council meeting. Drawing up this year's budget must have been as easy as falling off a log. The bottom line: the City has $15.4 million more in revenues and is having no trouble finding ways to spend it.

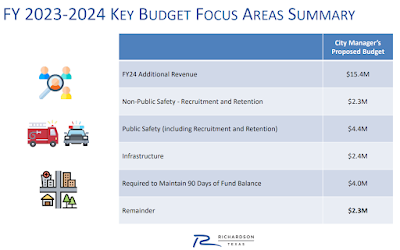

Proposal for the $15.4 million in new revenues:

The City’s total budget for FY 2023-2024 is $399 million, which is an increase of $44 million or 12.56% compared to FY 2022-2023. As reported earlier, the City's priorities are "Recruitment and retention," "Public Safety," and "Infrastructure."

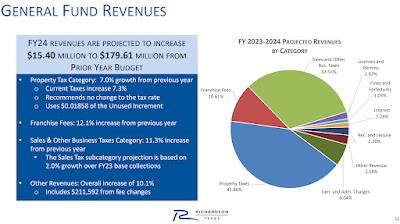

Summary of revenues:

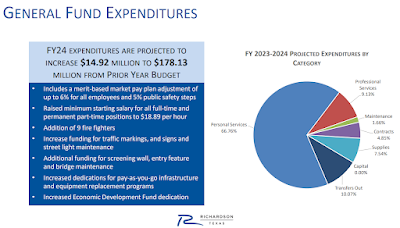

Summary of expenditures:

Summary of individual City funds:

FY24 Water and Sewer revenues are projected to increase $10.26 million to $106.05 million. Expenditures are projected to increase $9.80 million to $105.06 million. The result will be a 3.0% increase in water and sewer rates.

FY24 Solid Waste revenues are projected to increase $668,000 to $18.43 million. FY24 Solid Waste expenditures are projected to increase $754,000 to $18.21 million. The result will be a $1.00 per month rate increase for residential customers.

FY24 Golf revenues are expected to decrease $-259,000 to $2.57 million (closure of Course 2 until September for renovations). FY24 Golf expenditures are expected to decrease $39,000 TO $2.79 million. No fee changes are proposed at this time. This reflects a Transfer in from General Special Projects Fund of $595,000 to support the fund during the renovation of Course #2.

FY24 Hotel Tax revenues are expected to increase $3.36 million to $8.90 million. FY24 Hotel Tax expenditures expected to increase $3.85 million to $9.32 million.

The proposed tax rate will be kept at $0.5605 per $100 valuation. Because of increases in appraised property values, this steady tax rate will result in increased tax revenues. State law requires the City to describe that as a "tax increase."

The City Council's reaction to the proposed budget? The following are select quotes.

Joe Corcoran: "Can you just give us a brief outline of when some of those [TIF districts] are slated to either be dissolved or renewed? And...what we would do with any potential money or what we expect from that?" The response was that expirations are between 2031 and 2036, and after that "it won't be that different because, you know, we're still going to have to reinvest in streets, we're still going to have to reinvest in open space, we're still going to have to put in core infrastructure."

Jennifer Justice: "I want to give Councilman Hutchenrider a pat on the back for being the one that initially pushed to ask staff to go back and look at the 6% [staff raises across the board]. It's great that we were able to do that."

Mayor Pro Tem Arefin: "I wish we had more revenue sources so we could manage the infrastructure faster...Overall, this is a difficult year and hopefully next year is going to be much better for everyone." Apparently, Arefin didn't think like I did that building this budget was as easy as falling off a log.

Dan Barrios: "Coming from different groups are questions about increases and rates but not on golf rates." The response was, "We did go up last year on the golf rate so for course number one, we went up $2. And golf carts went up $2 as well...Maybe we could increase the rates on course number one but closing down one of our courses, and kind of significantly impacting that area out there with construction so far, I think we really felt it would be best to kind of keep rates where they're at for next year."

Curtis Dorian: "This is my first budget. It was a great deal of learning curve to understand all the different facets throughout the city and what it takes to make all of this transpire. So I just want to say a big shout out to the team. So thank you very much."

Ken Hutchenrider: "We have a lot of people travel outside of our city to go to liquor stores that are not in our city. We're losing out on that revenue. I don't want anybody to take this as I'm promoting alcohol sales. It's just that if there are going to be alcohol sales in our city I'd like us to have our fair share...When we think about Richardson Square Mall, that might be a perfect place for a Specs or Total Wine and More because there's really not anything over in that area and that would be a real positive from the perspective of tax revenues." The response was, "During COVID you could purchase, from restaurants and others, alcohol and as long as it was sealed, you could take that alcohol off premise for consumption. Well, Governor Abbott ended up making that a permanent change in law. And so the only thing you can't do now in Richardson is, [except for] the town of Buckingham because we have some grandfather locations, the only thing we're lacking right now is the ability to go in and to buy retail from a liquor establishment and then take that home for consumption...There is still an opportunity to move for one more enhancement, but it would necessitate the by-right establishment of liquor stores."

Mayor Dubey: "If this conservative estimate [of revenue increase over last

year] comes in at $15.4M, with our philosophy as a

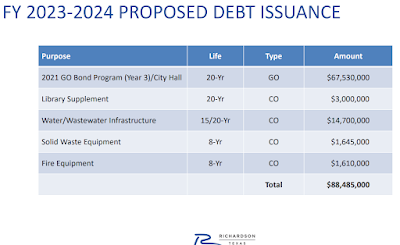

For the record, Richardson has $365 million of outstanding debt, up from

$250 million in 2013 (according to the 2022

Annual Comprehensive Financial Report). Richardson plans to issue $88

million of new debt next year, none of it with less than an eight year

maturity. Where Dubey got his understanding of Richardson's "philosophy as a

"Don Magner's deft hand,

Crafting budget's easy rise,

Funds at his command."

—h/t ChatGPT

No comments:

Post a Comment